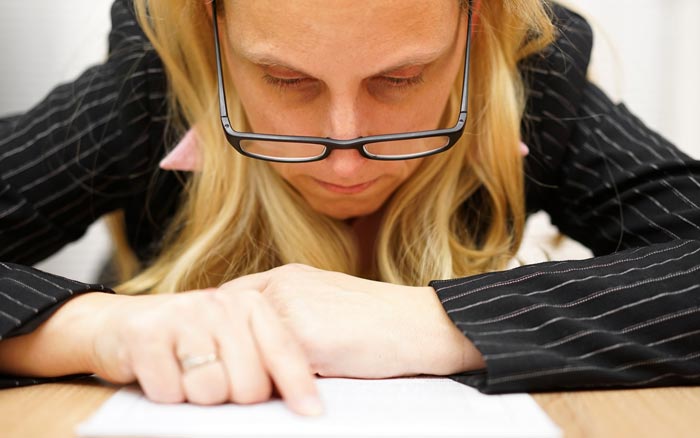

We have reached part 10, the final step in our 10-part checklist regarding 501(r) compliance for charitable hospitals. Now that you have addressed, and implemented the previous 9 steps into your hospital’s policies, it’s time for a little housekeeping. More to the point, the 10th step advises you to put on your reading glasses, and perform a thorough policy gap analysis.

What this means in practice is that you should begin carefully combing through hospital policies, to make sure they fall in line with the new 501(r) rules. Dot all “i”s, and cross all “t”s. A compliance team, or designated individual should be tasked with reading through all current hospital policy, looking for potential issues which might jeopardize your tax-exempt status. If official hospital policy contradicts or blocks patients from receiving charitable care, that would put you out of compliance. In other words, if what you do isn’t matching up with what you say, there could be trouble ahead.

Current policies should contain all required elements of the new legislation. Statements detailing how individuals can apply for assistance should be noted, as well as explanations of how discounts are determined. Someone reading the policies should be able to follow the hospital’s procedures for determining whether a patient is eligible for charitable care. There should also be some mention of the steps your organization will take prior to pursuing collections or legal actions.

If your current policies do not mention the new regulations, you could be inadvertently risking your status as a tax-exempt hospital. Every aspect of hospital operations must align with the 501(r) requirements, from daily billing operations, to CEO involvement, and even to the hospital’s written policies. Look for the gaps, and close them.

Your compliance team has a big job ahead of them, and while VARO Healthcare cannot assist you in a Policy Gap Analysis, there are 7 other ways in which we can assist your hospital that you may not have thought of in remaining tax-exempt, which can free up your time for the bigger issues. Download our complete checklist to ensure your hospital is covering all the basis and to find out how we can help!